NurPhoto/Getty Images

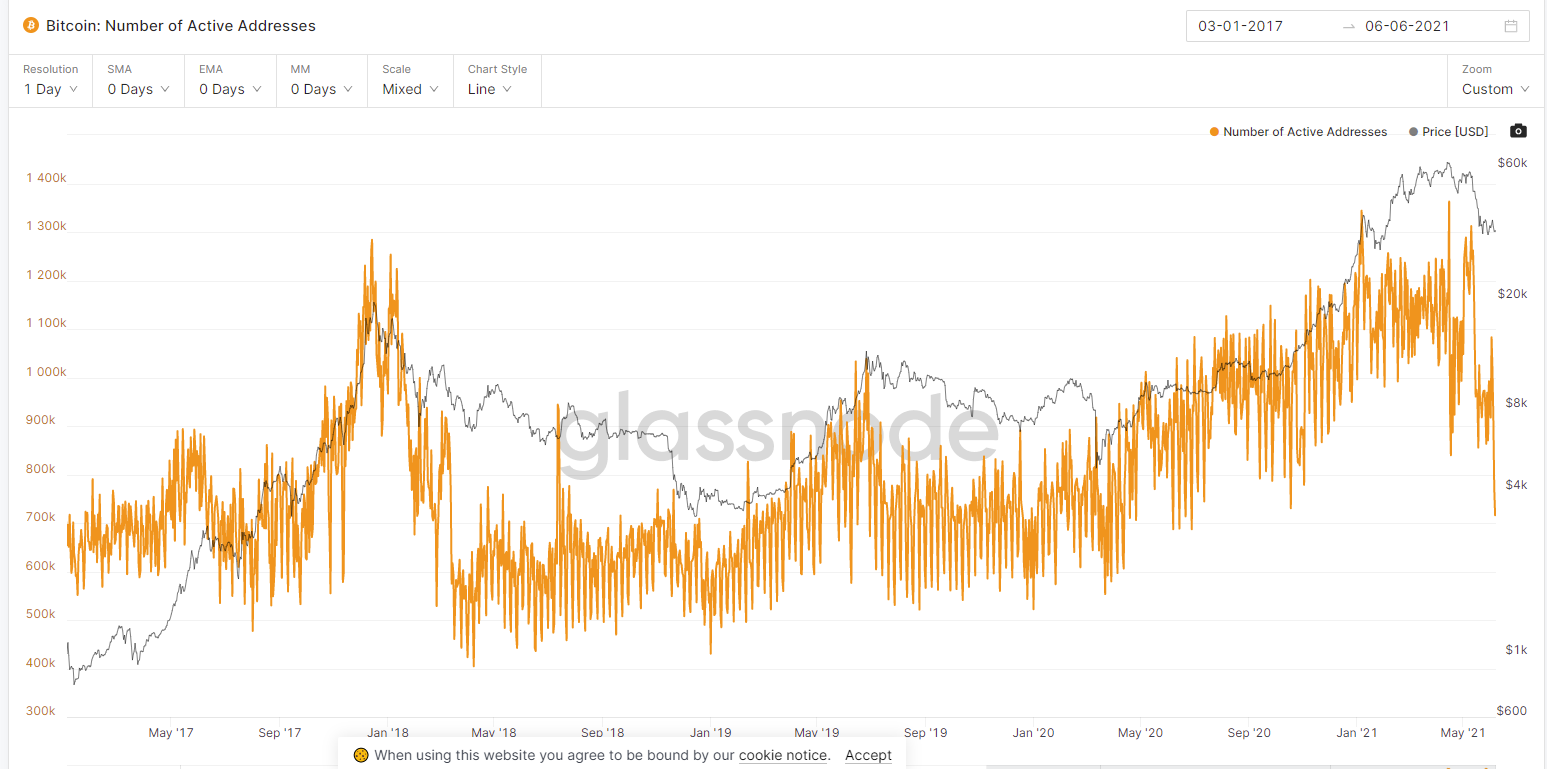

- The number of active bitcoin addresses fell roughly 47% from its April 15 peak to a low of 716,000 on Sunday, according to data from Glassnode.

- The last time bitcoin addresses sank so dramatically was during the 2017 bear market.

- The fall came despite bullish news from El Salvador and the Bitcoin 2021 Miami conference.

- Sign up here for our daily newsletter, 10 Things Before the Opening Bell.

The number of active bitcoin addresses dropped 47% from its April 15 peak of 1.36 million to around 716,000 on Sunday, according to data from the blockchain analytics firm Glassnode.

The active bitcoin address count is a sign of market demand for on-chain transactions, value settlement, and the urgency for inclusion in an upcoming block on the blockchain. A falling bitcoin active address figure typically coincides with bear markets in the space.

In 2017, when bitcoin's price cratered from a high above $19,587 per coin on December 16 to below $6900 on February 5, 2018, the number of active addresses also fell from a high of 1.284 million on December 14, 2017, to just 528,000 on February 25, 2018.

According to Glassnode's weekly on-chain report, "this week, in particular, the growth in on-chain demand has slowed markedly, with a number of on-chain metrics showing significant pull-backs."

The bearish news for bitcoin comes after Bitcoin Magazine sold out the Bitcoin 2021 Miami conference over the weekend. Over 12,000 attendees descended on Miami to support bitcoin and cryptocurrency development.

Speakers like MicroStrategy's Michael Saylor and Twitter's Jack Dorsey talked up digital assets and their potential to change the global financial system to thousands of cheering fans.

The conference also played host to an announcement from El Salvador's president, Nayib Bukele, who told the crypto community he sent a bill to the El Salvadorian congress that could make bitcoin legal tender in the country.

Despite the bullish news, bitcoin's price has traded between $34,000 and $39,000 for the past week, struggling to reclaim the key $40,000 resistance level.

Now, data from Glassnode suggesting a sustained drop in active bitcoin addresses compared to bitcoin's recent peak adds to the bearish tone surrounding the cryptocurrency.

Elon Musk's apparent reversal of his bitcoin stance may have also hurt bitcoin's prospects. Musk signaled a potential split with bitcoin when he posted a broken-heart emoji to Twitter last week.

The Tesla CEO's recent bitcoin comments drew the ire of the "hacktivist" group Anonymous on Friday. The group posted a video that targeted Musk for his "constantly trolling" of cryptocurrencies.

"For the past several years you have enjoyed one of the most favorable reputations of anyone in the billionaire class because you have tapped into the desire that many of us have to live in a world with electric cars and space exploration," the group said. "Recently… people are beginning to see you as another narcissistic rich dude who is desperate for attention."